- info@meritswift.com

- Find Nearest Branch

Select Account Type

Our Account Type

Online Banking at Fingertips

Platinum Checking Package

A top-tier checking account with competitive rates and all the perks

- Earn interest on the money you keep in your account

- No Bank fee for Non-U.S. Bank ATM Transactions

- Account opening deposit - £1,860

Joint Savings Account

Joint account for two or more individuals

- 2 or more individuals.

- No overdraft fees

- Account opening deposit - £2,400

Platinum Money Market Savings

Savings for Platinum Checking Package customers

- £0 monthly maintenance fee

- Account opening deposit - £6,000

- Must have a Platinum Checking Package to Apply

Easy Checking

A personal checking account with great standard features

- You'll get a U.S. Bank Visa Debit Card, and Online/Mobile Banking with Mobile Check Deposit, bill pay and more

- Access to more than 4,700 Bank ATMs

- Account opening deposit - £9,000

Standard Savings Account

Savings for low balances and first-time savers

- Account opening deposit - £2,000

- £4 monthly maintenance fee wadeable with £300 minimum daily ledger balance or £1,000 average monthly collected balance

Safe Debit Account

A bank account minus the checks with no overdraft fees

- No checks

- No overdraft fees

- Account opening deposit - £11,800

Certificate of Deposit(CD)

Certificates of deposit (CDs) are time deposit accounts. When you open a traditional CD account, it’s with the understanding that you’ll leave your savings in place for a set time period. This is called the maturity term and, during this time, you’ll earn interest on your balance.

- When you open acertificate of deposit with a financial institution, you agree to leave the money in the CD for a specified term

- CD terms typically range from six months to five years but may be shorter or longer, depending on the length of the term.

Individual Retirement Accounts (IRAs)

IRAs, or Individual Retirement Accounts, allow you to save independently for your retirement.

- These plans are useful if your employer doesn’t offer a 401(k) or other qualified employer sponsored retirement plan (QRP), including 403(b) and governmental 457(b), or you want to save more than your employer-sponsored plan allows.

- These accounts come in two types: the Traditional IRA and Roth IRA. The Roth IRA offers tax-free growth potential.

- You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account, presumably in retirement.

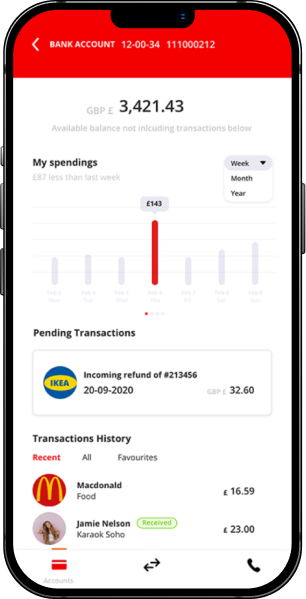

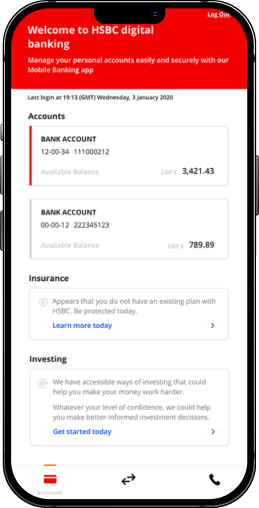

Mobile App

Get the Fastest and Most Secure Banking

Access a wide range of banking services and features digitally.